Debt Financing in Your

Own Way

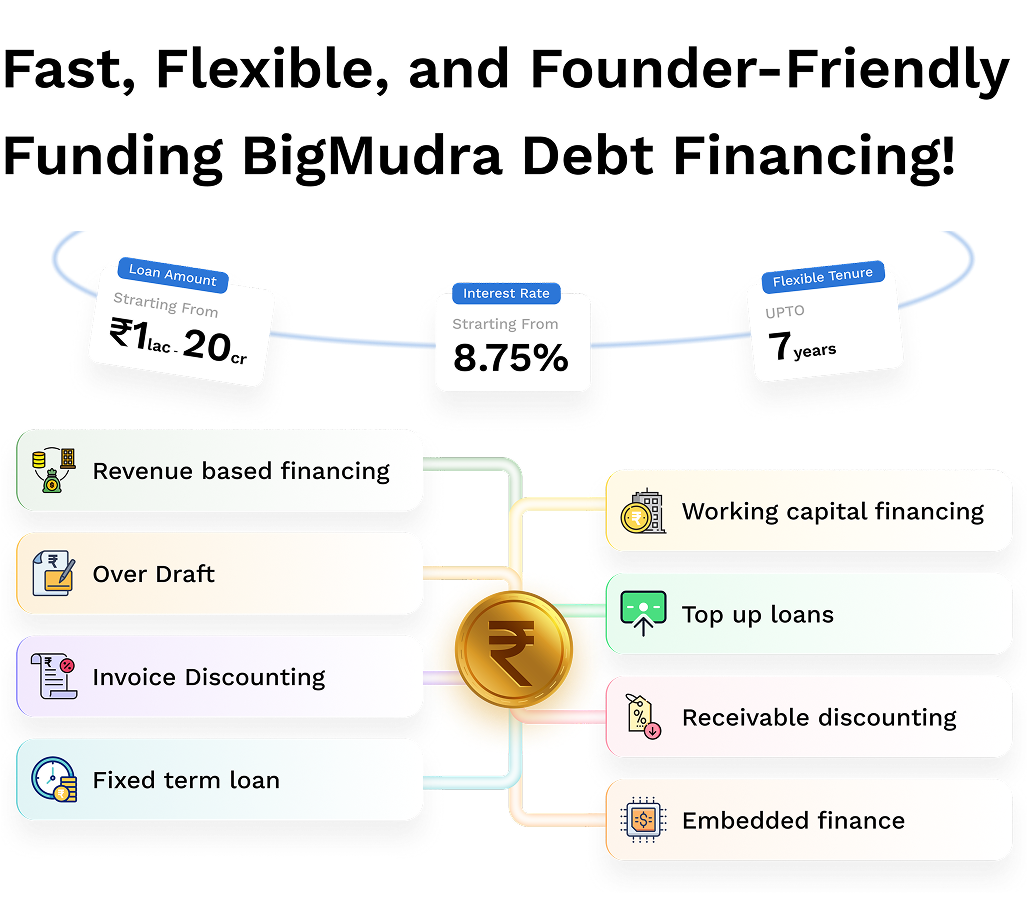

Debt financing lets you raise funds without giving up control. BigMudra makes it fast, easy, and tailored to your needs.

Holding It Down While You Build What Matters Most.

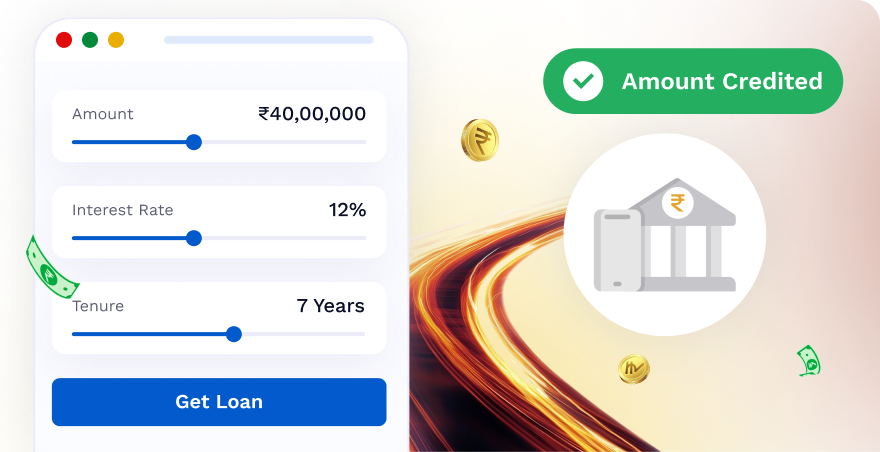

Loan EMI Calculator

Your monthly EMI is

₹17,107

9.00% interest rate per annum

Principal

₹ 1,00,000

Interest

₹ 2,641

Total Amount

₹ 1,02,641

Powering India’s Startups & MSMEs with Smart Finance Solutions

Powering India’s Startups & MSMEs with Smart Finance Solutions

Founder-First Funding

Get up to ₹20 crore capital without giving up equity or control.

Pan-India Reach

BigMudra brings smart financing to businesses across India with dedicated customer care.

Flexible Debt Financing

From early-stage startups to growing MSMEs, get custom-fit loans that suit your business needs.

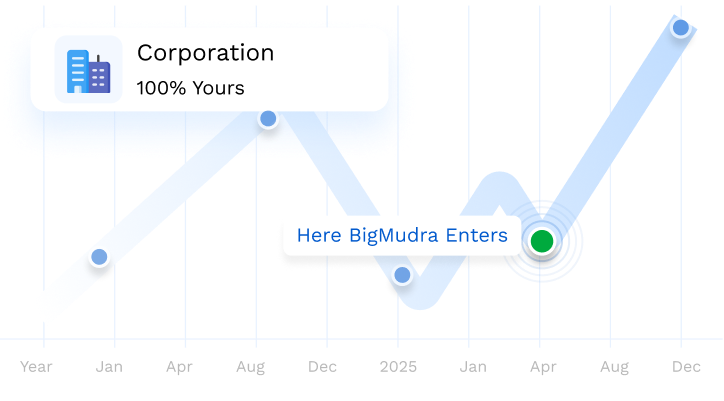

Growth, Not Dilution

Secure the capital you need to scale operations, innovate, and expand your business.

Fast, Transparent Process

Say goodbye to long waits and hidden charges, get quick approvals with complete clarity.

How Does It Work?

Apply Online

Fill out quick and easy form.Get Instant Approval

AI-powered verification speeds up the process.Receive Funds & Fulfill Your Dreams

Money is disbursed directly.

Who Can Apply?

Small & Medium Enterprises (SMEs)

Grow your business with ease.

Startups

Special loan plans for new businesses.

Service-Based Businesses

Get funds to upgrade, expand, or grow your service hustle.

Manufacturers & Traders

Funds for inventory, machinery, or expansion.

Women Entrepreneurs

Exclusive schemes for women-led businesses.

Retail Businesses

Easy financing options for store expansion.Empowering Founders to Succeed

At BigMudra, we help startups and businesses of all sizes grow and innovate with customizedsolutions to succeed in today’s market.

B2B SaaS

E-commerce Brands

Mobile Apps & Games

Wholesale & Distribution

D2C Brands

EdTech Startups

Frictionless Funding for Ambitious Founders

Access up to ₹20 crore in equity-free capital in days, not months. No complex processes, no insider connections needed. Focus on growth, not paperwork.

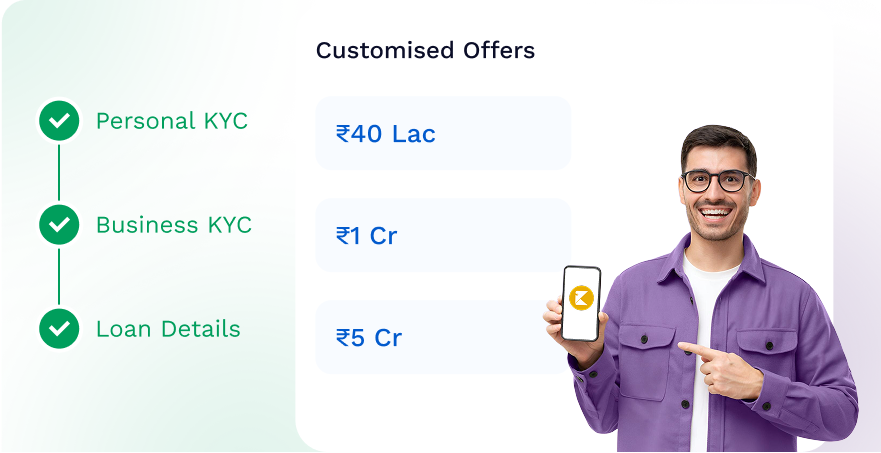

Share Your Data

Upload your marketing and revenue data securely. Receive an indicative term sheet in minutes and a tailored offer within days.

Get Funded Fast

Secure equity-free funding up to ₹20 crore in just 48 hours. Scale your business without delay.

Grow Without Stress

We are flexible about loan repayment so you can have peace of mind to focus on your business.Why Choose BigMudra For Debt Financing?

BigMudra is your trusted financial partner, offering quick and easy access to loans from a wide network of banks and NBFCs. We simplify the lending process to meet your financial needs.

Tax-Smart Advantages

Benefit from potential tax deductions on interest payments, reducing your overall EMIs.

Fully Digital Journey

Apply, upload documents, and track your loan status entirely online.

Flexible Loan Amounts

Access up to ₹20 Crores based on your eligibility and business needs.

Dedicated Expert Support

Get real-time help from your loan advisor whenever you need it.FAQs

What is debt financing?

Borrowing money to fund a business, repaid with interest over time.

What is debt in finance with an example?

Debt is borrowed money to be repaid, often with interest. Example: A business takes a $10,000 bank loan for equipment, repaying it with interest.

What is term debt financing?

A loan repaid over a set period with regular payments, like a 5-year loan with interest.

What is debt financing also known as?

Debt financing is also known as borrowing, loan financing, or credit financing.

What is an advantage of debt financing?

An advantage of debt financing is that you don’t give up ownership of your business.

Safe. Simple. Smart.

We believe in transparency. No hidden charges. No confusing terms. Just clear and honest financial support to help your business grow.